April 2025

On April 1st, RBI celebrated its 90th birthday.

RBI is one of the great institutions of this country and the RBI is shaping this country’s payments/FinTech landscape with a clear goal post - Integrity, Inclusion, Innovation, Institutionalization, Internationalization. [Article]

I. Story 1: 1st April

April 1st is a unique date… yes, it is April fools day 🙂

On that day, we commence our Financial Year, and banks clean up things at their end, and for some reason banks stop NEFT and RTGS transfers, and this April, SBI stopped UPI as well.

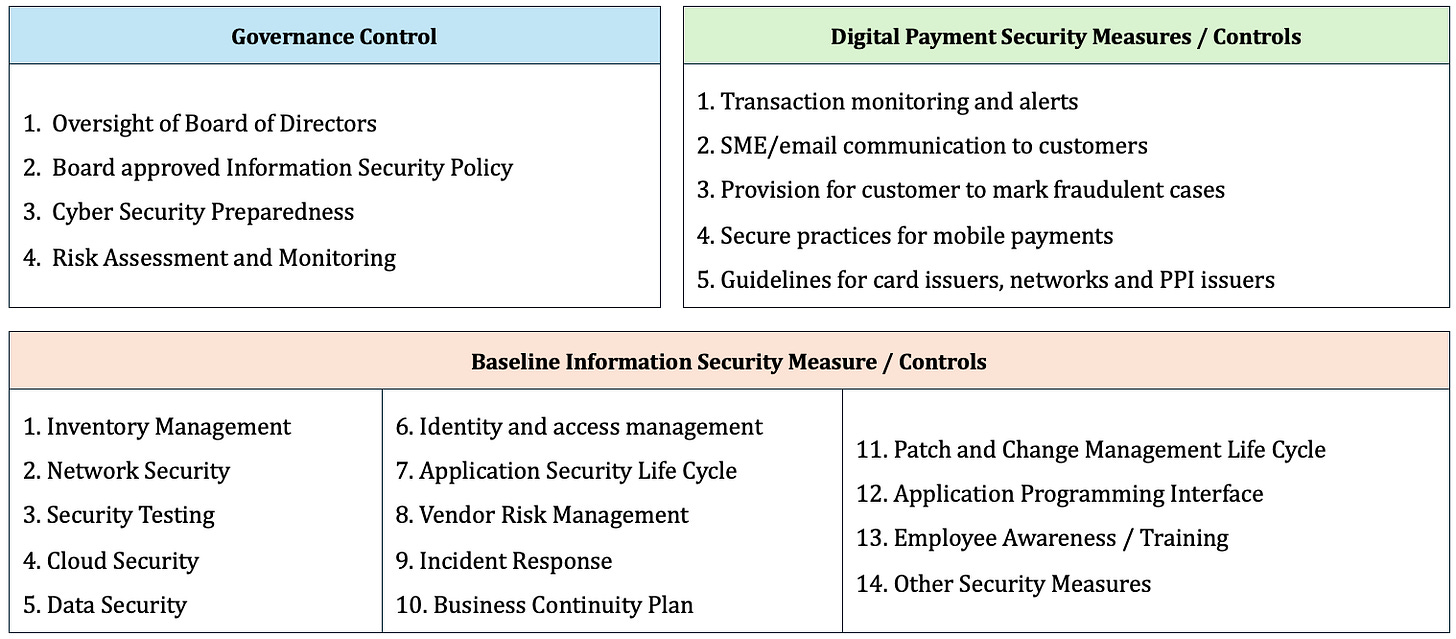

On this 1st April, Master Directions on Cyber Resilience and Digital Payment Security Controls for non-bank Payment System Operators (PSOs), that were issued on 30-July-2024, came into effect for large non-bank PSOs (CCIL, NPCI, NBBL, card networks, non-bank ATMs, large PPIs, TReDS operators, BBPOUs, PAs).

This is one of the most important directions issued by the RBI that covers the following areas.

For details, please read the Master Directions [Link]

II. NPCI Realm

A. UPI went down (again and again)

UPI had major disruption on 12th April;

Banks were expected to call Transaction Status API maximum three times with an interval of 90 seconds between each API call.

In the world of ‘instant gratification’, banks didn’t implement these limits and flooded NPCI’s systems which deteriorated the performance of UPI.

NPCI has floated to circulars to improve performance of UPI and reduce system overloads

To improve the performance of UPI, NPCI has reduced response times for Request & Response Pay, Check status, transaction reversal and validate address APIs [Link]. [Deadline: 16 June 2025]

Restriction are enforced for Check Transaction Status API [Link]

B. Additional Initiation mode for Rent Repayment [Link]

Rent repayment transactions under MCC 6513 are allowed under initiation mode 03 (i.e. Bharat QR), apart from existing initiation modes - 00 (Normal Transaction), 01 (Static QR Code - Offline), 02 (Static Secure Code - Offline), 04 (Intent), 05 (Secure Intent), 10 (SDK).

This is not applicable for One-Time Mandate and AutoPay.

C. Blocked QR Share & Pay for UPI Global P2M [Link]

NPCI has blocked all QR Share & Pay for all UPI Global P2M transactions; this to safeguard the users.

D. Beneficiary Name verification and Display [Link]

NPCI has mandated UPI Apps to implement following changes by 30th June 2025

Display ultimate beneficiary name for P2P and P2PM payments

Disable any feature that allows user to change beneficiary name

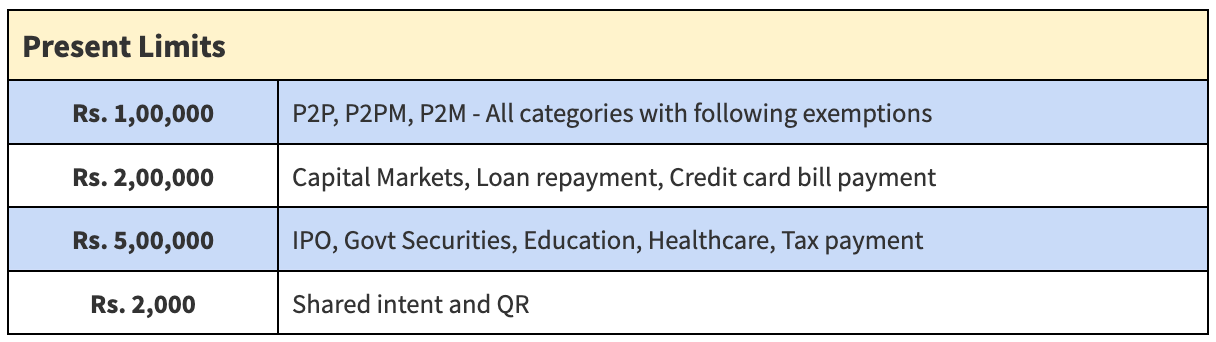

E. UPI Limit decision with NPCI

RBI has allowed NPCI to enhance P2M limits for various use cases

Present limits are not sufficient for higher ticket payments of B2B, BFSI, Education and Tax payments. So increasing UPI limits will cover such use cases with exception where payment done via current account.

RBI has given freedom to NPCI to enhance the limits and at the same time, given freedom to banks to add their own limits (<= NPCI’s limit). Even if NPCI acts liberally, banks won’t.

Will increased limits on UPI cannibalize net-banking volume?

Yes, possible (Although UPI doesn’t support current a/c so net-banking may remain important mode for B2B cases)

Will the new Interoperable net-banking model become redundant?

Quite possible - If UPI can solve the problem then why a new payment system is needed.

F. NPCI’s Federated Model to reduce frauds

NPCI is working on a pilot project, Federated Model, with selected few banks to build an AI driven fraud detection system. The system works on ‘customer scores’ where NPCI scores basis transaction pattern, devices etc whereas banks score basis customer’s age, occupation etc.. The scoring mechanism will enable banks to detect frauds while protecting the customer’s privacy.

III. RBI Realm

A. RBI’s verified WhatsApp channel

RBI launched a verified WhatsApp channel to increase consumer awareness. Along with social media, mass media channels, WhatsApp will enable RBI to reach a wider consumer base and deliver messages faster. A user can scan the QR (refer to this link) and join the channel.

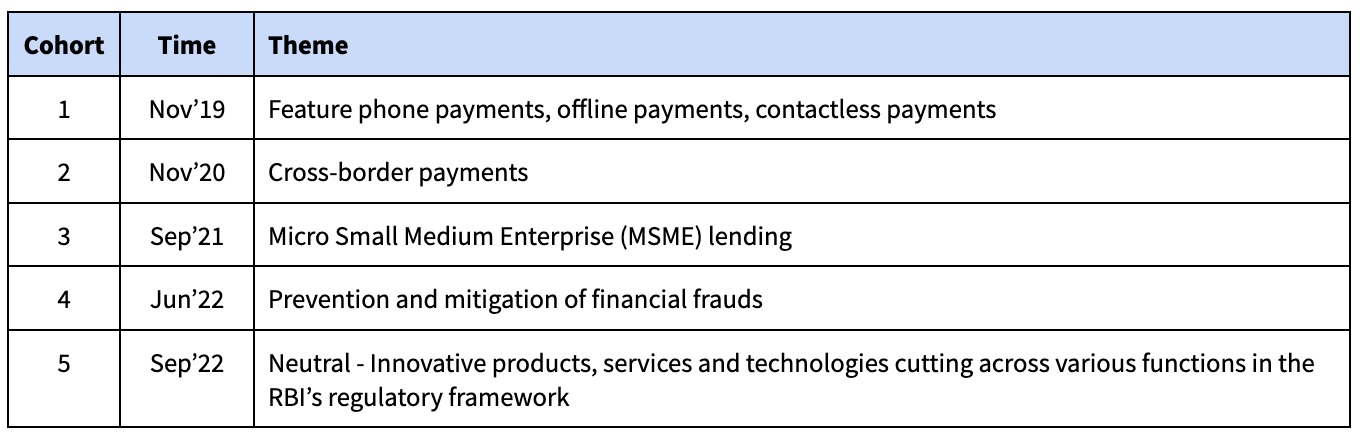

B. Sandbox

RBI came up with the sandbox concept to boost innovations in FinTech and Payments space. Sandbox provides a controlled environment for companies and RBI, before release the product/concept to the ecosystem

So far RBI has operated five sandboxes on various themes

Going forward, instead of ‘theme based’ sandboxes, RBI is making regulatory sandboxes as Theme Neutral or On-Tap.

C. Deadline for banks to migrate to ‘.bank.in’ domain

In Feb '25 update (link), we had covered RBI’s plan to introduce new domains, bank.in (for banks) and fin.in (for other financial institutes) to safeguard users against financial frauds.

On 22-April-2025, RBI has set the deadline of 31-Oct-2025 for the banks to migrate to new “.bank.in” domain

New domains will be operationalized through Institute for Development and Research in Banking Technology (IDRBT), which has been authorised by National Internet Exchange of India (NIXI).

D. RBI fines and penalties

RBI has levied Rs.4.66 Crore fine on nine banks and NBFCs

CITI Bank - Rs.3.2 lakh for non-compliance with FEMA

Kotak Mahindra Bank - Rs. 61.4 Lakh for non-compliance with certain directions issued by RBI on ‘Guidelines on Loan System for Delivery of Bank Credit’ and ‘Loans and Advances – Statutory and Other Restrictions

IDFC First Bank Limited - Rs. 38.6 Lakh for non-compliance with certain directions issued by RBI on ‘Know Your Customer (KYC)’.

Punjab National Bank - Rs. 29.6 Lakh non-compliance with certain directions issued by RBI on ‘Customer Service in Banks’

Indian Bank (Rs. 1.614 Crore) and Indian Overseas Bank (Rs.63.6Lakh) for non-compliance with certain directions issued by RBI on ‘Interest Rate on Advances’, ‘Kisan Credit Card (KCC) Scheme’ and ‘Lending to MSME Sector’

IV. Payment Entities/FinTech Realm

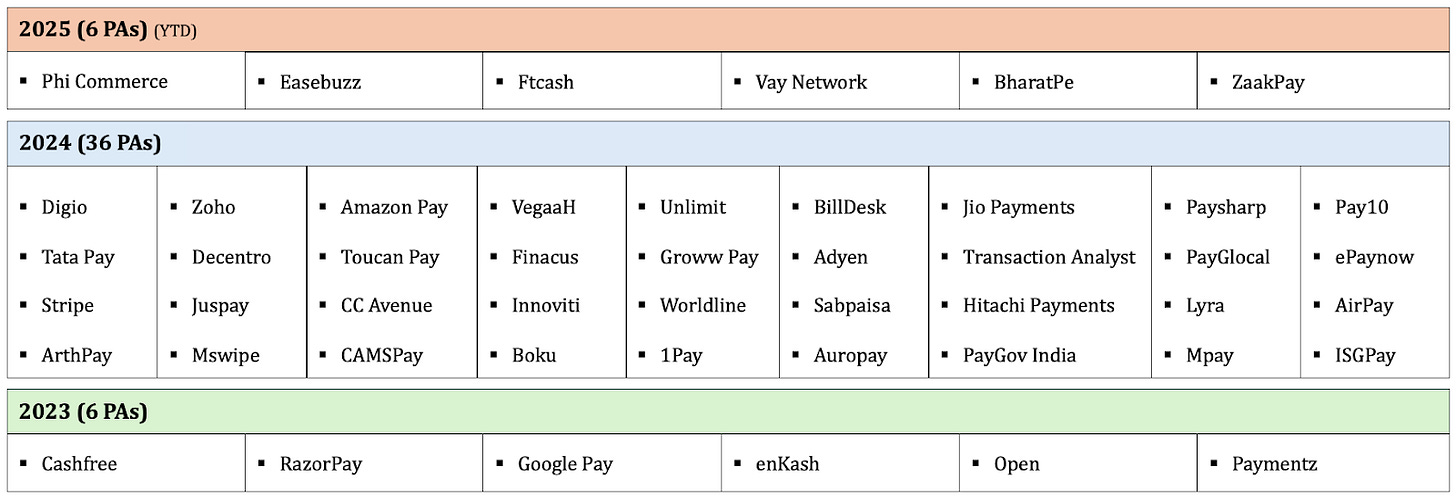

A. PA - Online

BharatPe and ZaakPay received PA license; the count of licensed PAs is 48

B. PPI

Revolut (India) received RBI’s approval to operate PPI (Prepaid Payment Instrument). With PPI, Revolut will participate in the UPI ecosystem (UPI + PPI linking).

Revolut already holds an Authorized Dealer- II (AD-II) license, which is required for cross-border payments under LRS (Liberalized Remittance Schemes).

Note: There are total 49 RBI licensed PPIs

C. Funding and Acquisitions

Juspay, payment infrastructure company, raised $60 M as part of Series D funding from Kedaara Capital and existing investors (Softbank and Accel)

Easebuzz, payment aggregator, raise $30M from Bessemer Venture Partners and existing investors (8i Ventures, Varanium Capital)

Amazon invested $30M in its payments arm, Amazon Pay. Amazon Pay holds RBI’s PPI (Prepaid Payment Instrument) and PA (Payment Aggregator licenses, and is one of top UPI Apps.

Jai Kisan, a Fintech focused on farmers/rural, raise $3M as part extended Series B round

Credit Saison India, an NBFC, raised $300M via External Commercial Borrowing (ECB). (Note: ECB is loan taken by Indian entity from non-Indian entities in foreign currency)

Three payments giants are getting ready for IPO; Pinelabs received NCLT approval, and PhonePe and RazorPay have become ‘Public Limited’ from ‘Private Limited’.

ICICI Bank completed sales of its entire 19% stake of ICICI Merchant Services (IMSL) to First Data

Global Payments plans to acquire WorldPay for $24.25B, and plans to sell its issuer side business to FIS for $13.5B. Looks like Global Payments is strengthening its acquiring business. In India, Global Payments operates both offline and online payment, and is currently seeking RBI’ approval. [Status: application under process and not allowed to onboard new merchants]

Story 2: Project Nexus

Real Time Payments (RTP) / Fast Payments / Instant Payments rails are booming across the globe. [Article]

RTPs/FPs are designed to provide economical and instant payment solutions for P2P and P2M use cases. After catering domestic business, now many of these RTPs are going for international expansion.

One of the use case is interlinking RTPs of different countries for cross-border remittance (e.g. UPI <> Paynow, PayNow <> DuitNow)

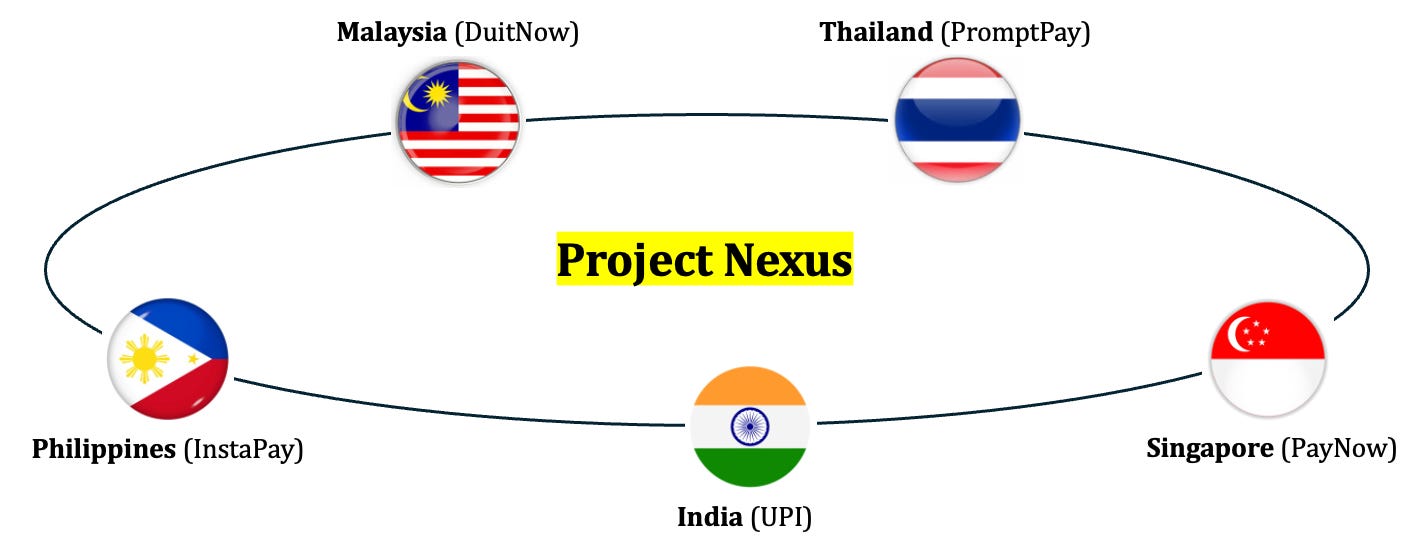

A much bigger game is connecting multiple RTPs to enable multi-lateral cross-border remittance and one such ambitious project is ‘Project Nexus’. A brainchild of Bank of International Settlements (BIS) where RTPs of five countries will be interlinked.

Latest development of this month is that Nexus Global Payments (NGP), managing body of Project Nexus, is incorporated as a Non-Profit Organization.

Project Nexus is a bold and innovative program, and it will be interesting to see how this will shape up and grow. [Reference link]

RTPs in Europe:

We are witnessing similar initiates in Europe -

Bizum (Spain), Bancomat Pay (Italy), and MB Way (Portugal) have launched EuroPA an initiative that enables users to send money across borders 𝘂𝘀𝗶𝗻𝗴 𝗷𝘂𝘀𝘁 𝗮 𝗽𝗵𝗼𝗻𝗲 𝗻𝘂𝗺𝗯𝗲𝗿.

The platform is built on SCT Inst infrastructure and the platform will support P2P payments and will connect 50M+ users and 186 financial institutes. [Source]

Christine Lagarde, President of European Central Bank, has called for payment innovations in Europe and to reduce dependency on US and Chinese platforms such as Visa, MasterCard, PayPal and Alipay.

This is no different than what is happening across the globe - growth of sovereign payment platforms and infrastructure that will truly safeguard a country’s own interests [source]

That's the wrap of April 2025!

[Read, subscribe, share]

Always look forward to these every month