May 2025

May was a bit of a slow month for me - I took a break in the Austrian Alps and enjoyed Bavarian beer.

Meanwhile, quite a few things happened in the payments domain.

I. NPCI Realm

More measures to improve performance of UPI

After a few deterioration and downtimes in April, NPCI is working on improving the performance of UPI.

NPCI is aiming to reduce the API calls/requests to control the overloading of its systems.

In April, NPCI issued two circulars on (1) reducing response times and (2) restriction on check transaction status API. And in May-2025, NPCI issued a more broader guideline for UPI APIs and to be implemented by 31-Jul-2025 [Link]

In general, NPCI is prohibiting usage of stand alone APIs for other purposes

Peak Hours: 10AM-13:00 and 17:00-21:30

UPI Apps to get audited by CERT-In empanelled auditor and submit report by 31-Aug-2025

Failure to adherence may attract API restrictions, penalties, and/or embargo

II. RBI Realm

A. PRAVAAH [Link]

RBI instructed all regulated entities (banks, PSOs) to submit applications related to authorization, approval, license on PRAVAAH (Platform for Regulatory Application, Validation and Authorization) portal starting 1-May-2025. PRAVAAH was launched in 28-May-2024

B. Financial Fraud Risk Indicator by the DoT [Link]

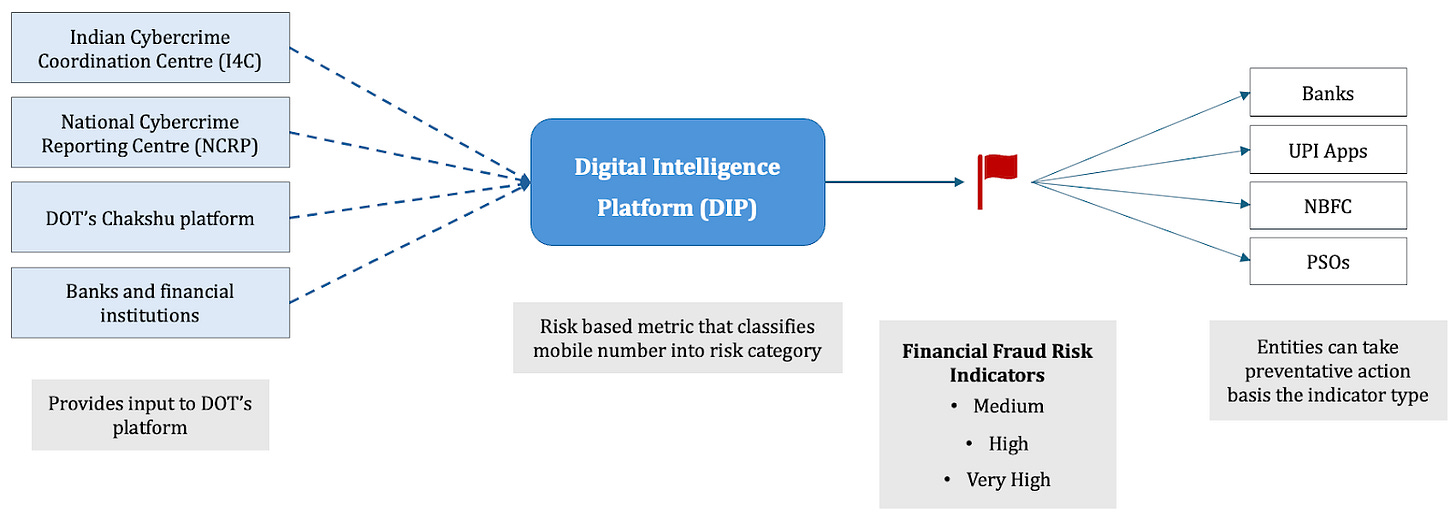

The Department of Telecommunication (DoT) has introduced the Financial Fraud Risk Indicator (FRI). Based on various inputs, DoT’s Digital Intelligence Platform will classify the mobile number into the risk category - Medium, High, Very High.

Financial institutes/FinTechs (Banks, NBFCs, UPI Apps) can use this indicator to take appropriate action such as blocking the transaction or showing alerts about potential fraud merchants.

C. Framework for regulations [Link]

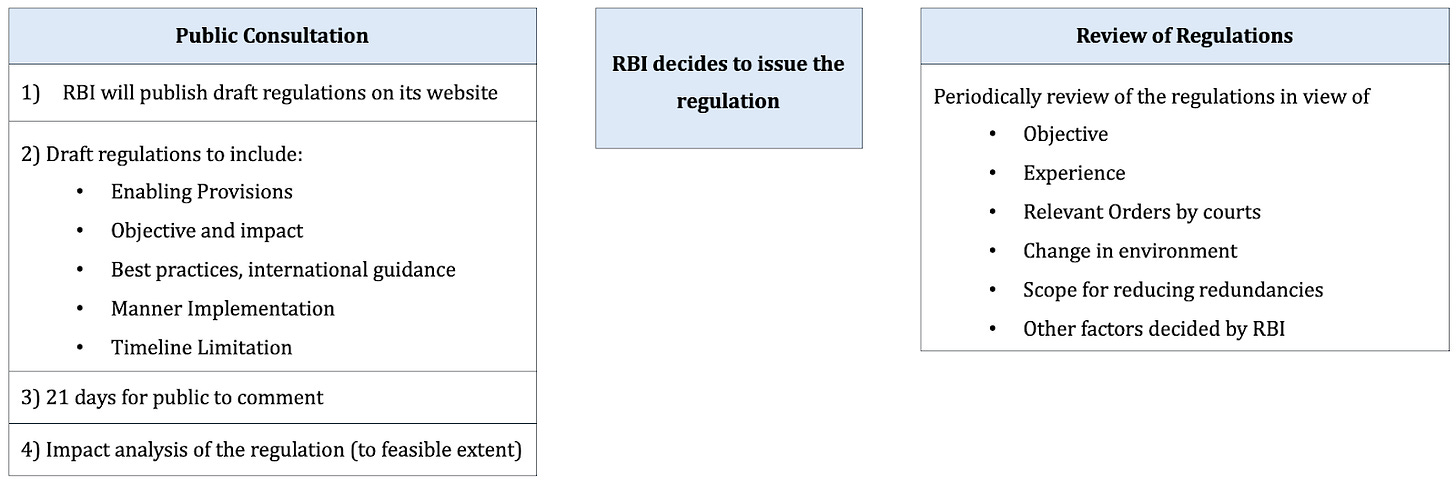

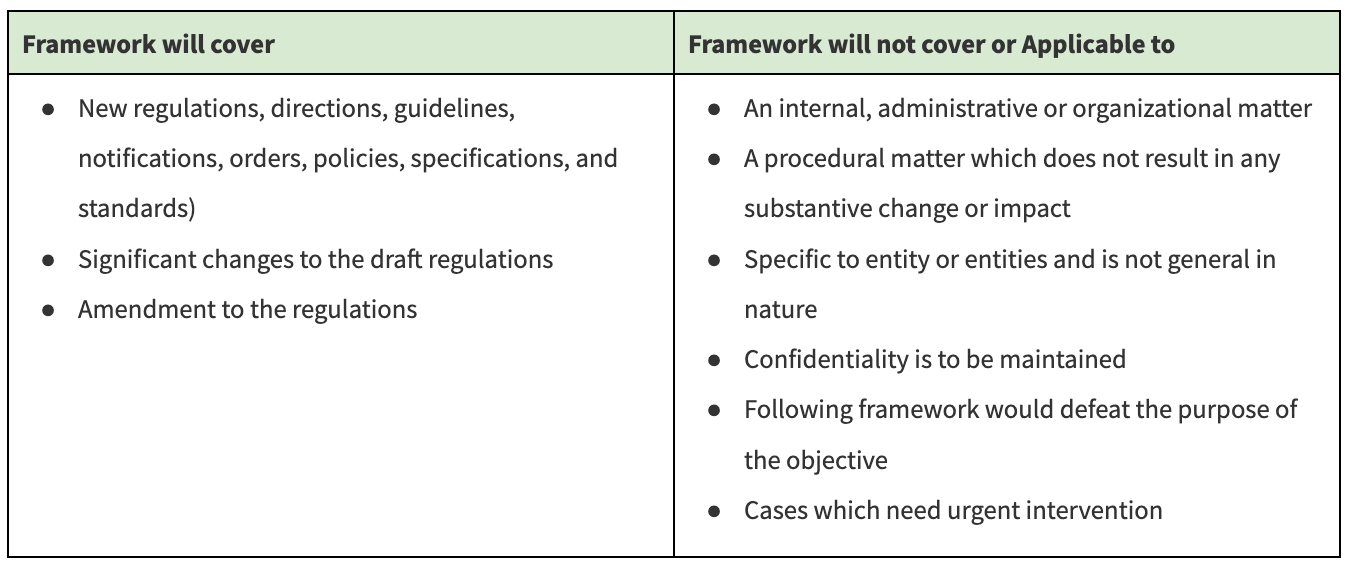

RBI has formulated a framework for issuing regulations.

D. Payments Regulatory Board [Link]

RBI has notified the formation of the Payments Regulatory Board (PRB) to replace the existing Board for Regulations and Supervision of Payment and Settlement Systems (BPSS) to oversee all payments and settlement systems.

Apart from the size of the board, GoI can nominate 3 officers to the board for the non-renewable tenure of 4 years. The board is expected to meet at least twice in a year.

Also, PRB can invite experts from payments, IT and Law on a permanent or ad-hoc basis to attend meetings.

E. Increase in ATM fees

RBI has increased fees for cash withdrawal (Rs.17 → Rs.19) and fees for balance enquiry (Rs.6 → Rs.7) effective 1-May-2025. These fees are applicable on;

User has exhausted monthly limits i.e. 5 for metro and 3 for non-metro

User uses the card on other than her home bank’s ATM including white-label ATM (e.g. when you use your HDFC debit card to withdraw cash in ICICI bank’s ATM)

Note: Your bank would add some more additional fees on top of these base rates

F. Fines and Penalties

RBI has imposed a total penalty of 7.366 Crore on 28 entities

6.684 Cr fine on banks ten banks including SBI, ICICI, Axis, Deutsche, Jana SFB

27.7 Lakh fine on 16 Co-operative banks

40.5 Lakh fine on 2 NBFCs

III. Payment Entities/FinTech Realm

A. PA - Online

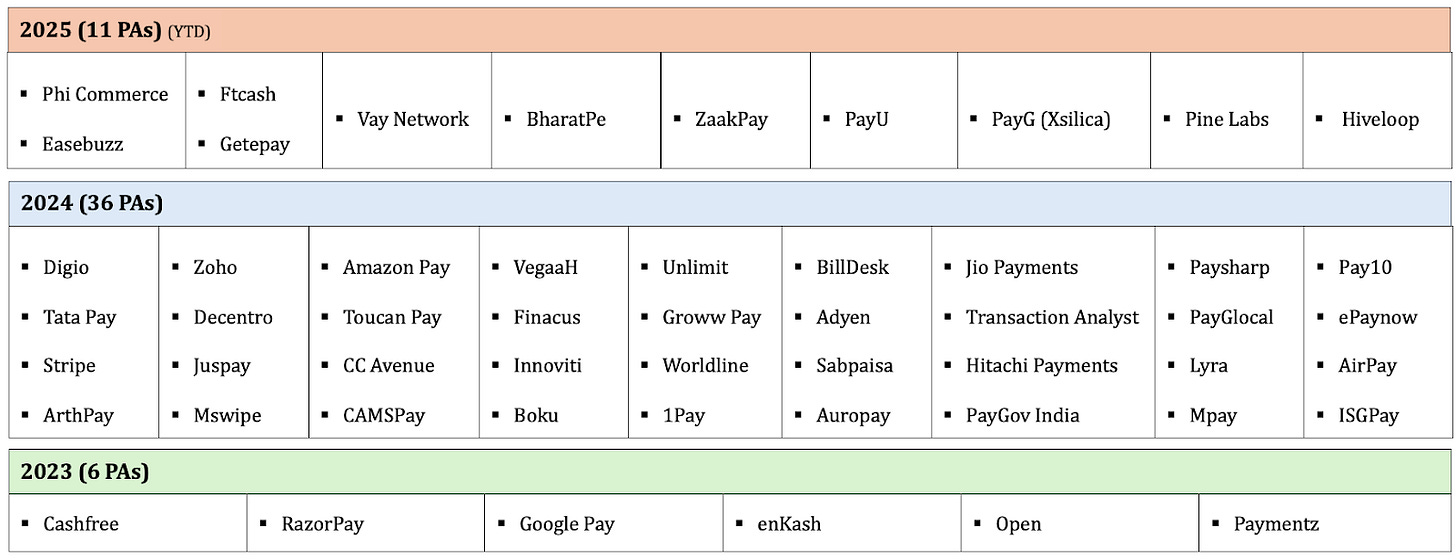

PayU, Pine Labs, Getepay (Futuretek Commerce), Hiveloop and PayG (Xsilica Software Solutions) received final authorization from RBI. The total number of Authorized online PAs: 53

B. PA-Cross Border

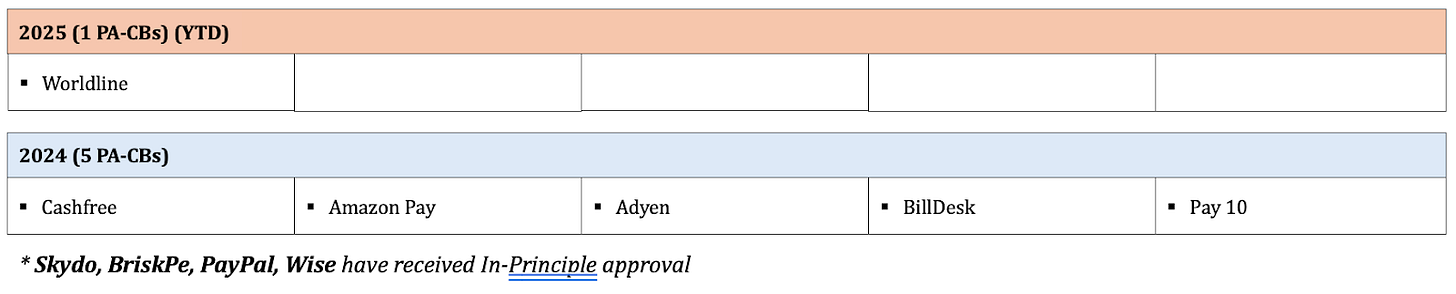

Worldline received the final authorization for PA-CB. Total authorized PA-CBs: 6

Two global giants, PayPal and Wise, received in-principle approval.

C. Funding, Acquisition and other updates:

Cred raised $75M at valuation of $3.5Billion (In it last round, Cred was valued at $6.4B)

RazorPay completed a reverse flip- domicile change from USA to India. This is another important step towards IPO.

The name of North East Small Finance Bank Ltd was changed to Slice Small Finance Bank Ltd.

Zoho (India born SaaS company) launched Zoho Payments in the USA.

Also, Zoho has received a license from RBI to operate as Payment Aggregator in India.

Interesting: Curious Case of MCCs

RBI has started a closer check on misclassification of Merchant Category Codes (MCCs) [Link], especially the trends of classifying retail merchants under utility category (Utility MCCs have lower MDR on credit cards compared to other categories)

PAs/Banks classify merchants under wrong MCCs (mostly knowingly and at times unknowingly) to (1) take advantage of interchange/arbitrage (2) onboard high risk merchants (which typically are ready to pay higher MDR just to get MID).

This may lead to losses to banks and networks, and may impact customers as fraudulent merchants will be onboarded.

Few networks (MasterCard and RuPay) have increased interchange for the Utility sector and issuing banks will start charging surcharge fees from card holders. (HDFC is already issued notice for this)

RBI’s move is important - it is high time to clean up this mess!

That's the wrap of May 2025!

[Read, subscribe, share]